2017 federal budget highlights

Budget in short

The federal government tabled the 2017-18 budget plan on March 22. Compared to last year’s budget, there are far fewer new initiatives outlined in this year’s plan – $1.3 billion of new spending was announced for the current year compared to $14.9 billion last year. The bulk of the budget provides some more detail on how previously-announced funds (especially for infrastructure) will be allocated between different programs and priorities. Beyond the continued theme of supporting the “middle class,” the budget outlines a number of programs and policy choices aimed at promoting innovation, including plans to encourage “superclusters” and encouraging higher exports of goods and services.

There was very little direct mention of poverty reduction in the budget or the forthcoming Poverty Reduction Strategy. The areas of greatest interest for Maytree were some long-term funding commitments for affordable housing, some commitments related to data, and some other more modest measures related to renewing the social contract (e.g. caregiving, child care, and skills training).

The budget bottom line

The economic picture surrounding the budget is fairly close to how it looked at the time of the last budget or the fall economic update. While GDP growth is projected to be somewhat weaker than in the fall, the projections for government fiscal outlook have improved between the fall and the budget.

Almost all of the spending in the budget had been accounted for in the overall budget plans for the coming years (the “fiscal framework”). The budget plan mostly outlines how those existing commitments will be rolled out, and in some cases moves funds from one priority to another.

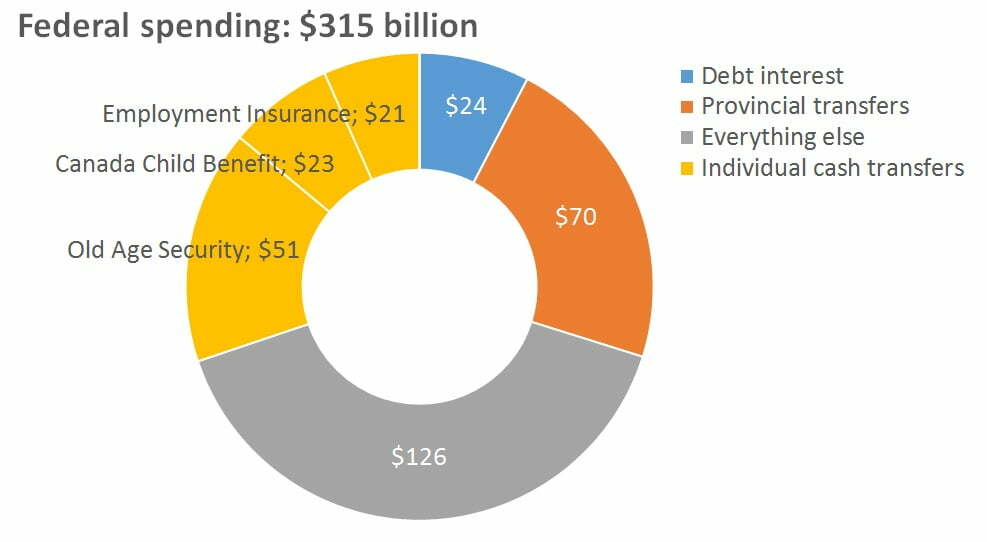

On net the new spending commitments in this budget add $3.6 billion in spending over the next five years. That is well within normal fluctuations for a budget that totals $315 billion (and growing). The government is projecting a $28.5 billion deficit this year, including a $3 billion risk cushion. Sizable deficits are projected to continue for the foreseeable future, declining to $18.8 billion in 2021-2022.

It’s helpful to look at the $315 billion in federal spending in context to see what is really being decided on with any given budget plan. Of total federal spending, much is spoken for in different ways. $24 billion will go to pay interest on the debt. The major transfers to provinces and territories are driven by formulas in long-term commitments and add up to $70 billion this year. A further $95 billion go to the largest cash transfers to individuals, whether through Old Age Security ($51 billion), the Canada Child Benefit ($23 billion) or Employment Insurance ($21 billion). Together these account for about 60 per cent of the federal budget.

Housing

- The section on housing opened with the statement “All Canadians need and deserve housing that is safe, adequate and affordable” echoing Maytree’s submission to the Let’s Talk Housing consultation.

- The feature housing commitment in the budget is $11.2 billion over 11 years from the Social Infrastructure Fund for affordable housing, beginning in 2018-19. This commitment is similar to the request made by the Federation of Canadian Municipalities, who called for $12.6 billion of the fund to go to affordable housing. The long time frame is consistent with other federal infrastructure funding initially announced last year. The overall annual commitment is lower than it has been for the last two years but higher than it had been for the preceding 20. Of the $11.2 billion:

- $3.2 billion will be transferred to provincial and territorial governments, starting in 2019-2020. This will be part of a new agreement that will be negotiated to follow the current Investment in Affordable Housing program.

- $5 billion through a new National Housing Fund administered by the federal government through the Canada Mortgage and Housing Corporation. This in itself is significant, as it represents the federal government potentially being more directly involved in affordable housing programs than it has been in decades (rather than simply writing cheques). The new fund only has broad goals and vague definition so far but includes funding for preserving the affordability of existing social housing, incentives for affordable rental housing development, and new capital investments for affordable housing.

- $2.1 billion for expanded and extended funding for the Homelessness Partnering Strategy. This is at least a 60 per cent increase over current funding levels.

- $300 million for Northern housing, $225M for Indigenous housing off-reserve, and $202 million to make federal lands available for affordable housing development.

- In addition to that funding the government has committed to preserving the baseline social housing operating funding at current levels as operating agreements expire. This funding is currently worth about $1.6 billion each year, and preserving that level over the next 11 years represents keeping a net investment of about $4.8 billion total. As operating agreements expire, this won’t necessarily flow into extended or renewed operating agreements, but will be kept in affordable housing.

- Housing funding for First Nations communities is also separate and distinct from this housing funding. Some of the recently announced federal mental health funding will also likely be directed to supportive housing and Housing First programs.

Renewing the Social Contract

Child care

- The budget commits $7 billion over ten years for early learning and child care (increasing from a $500 million one-year investment this year). The federal government is currently negotiating a national framework for this file with provinces, given education is a provincial responsibility.

- The government will waive Labour Market Impact Assessment processing fees for families hiring foreign nannies (for households with income less than $150,000).

- The Investment Tax Credit for Child Care Spaces for employer-sponsored care spaces is gone.

Parental leave

- As expected, a new option will be made available as part of the Employment Insurance to take parental leave over 18 months at 33 per cent replacement rate of insured earnings, alongside the status quo of up to 12 months at up to 55 per cent. Changes will also allow mothers to begin maternity benefits up to 12 weeks before expected due date (rather than 8 weeks). (Maytree has a backgrounder on these issues for those who want to learn more).

- The government will change the Canada Labour Code to provide job protection for parental leave for federally-regulated sectors (six per cent of the workforce). Beyond parental leave, the code will be amended to allow employees to request more flexible work arrangements, such as flexible start and end time and working from home, as well as unpaid leaves for family responsibilities.

Caregiving

- The budget creates a new Employment Insurance caregiver benefit of up to 15 weeks. This expands on the more limited and barely used Compassionate Care leave benefits in EI, which covered a longer period of time but only for care of those at significant risk of death. The new benefit will cover a broader range of situations where a family member requires significant support to recover. There is also a continued program for caring for critically ill children, available for up to 35 weeks.

- Waiving processing fees for families hiring a foreign caregiver for a person with high medical needs.

- Three different caregiving tax credits (the Infirm Dependant Credit, the Caregiver Credit, and the Family Caregiver Tax Credit) will be combined for a new Canada Caregiver Credit. The new credit maximum amount is $6,883 (a cash value of $1,032). It is a non-refundable credit that phases out between $16,163 and $23,046 (effectively losing 15 cents of support for each new dollar of earning). It is expected to reach more people than the existing trio of credits (including caregivers that don’t live with those that they are providing care for).

Skills training and work

- The budget makes a commitment to undertake a “significant reform” of the set of four labour market transfer agreements that sends money through the provinces for labour market skill training. The Labour Market Development Agreements (funded out of Employment Insurance Premiums, to provide training for EI-eligible unemployed people) will get an additional $300 million per year (an approximately 15 per cent increase) for six years starting this year. The government will also look to amend the legislation so that eligibility for these programs becomes more broad, so a wider range of workers can use the programs.

- There will also be additional money for a new Workforce Development Fund which rolls together the Canada Job Fund Agreements (which used to be called the Labour Market Agreements, before the Conservatives brought in the Canada Job Grant), the Labour Market Agreements for Persons with Disabilities, and the Targeted Initiative for Older Workers. This new agreement will get a net increase of $150 million per year for six years. There is also a slight funding boost for the Aboriginal Skills and Employment Training Strategy (which remains its own program)

- To encourage life long learning, the federal government will increase eligibility for Canada Student Loans and Grants for part-time students. They are also piloting a measure to increase eligibility for student loans for mid-career workers who might not have been eligible because of prior-year income, and making it easier to pursue self-funded education and training while claiming EI.

- There are a number of investments for youth skills and education, including an additional $395.5 million over 3 years for the Youth Employment Strategy and $38 million in funding to Pathways to Education Canada for programs to help vulnerable youth complete high school and transition to Post-Secondary Education and employment. There is also increased funding for post-secondary education access for Indigenous youth.

- The federal government is eliminating unpaid internships in federally-regulated sectors, except for when it’s part of a formal education program.

- The budget proposes to provide $132.4 million over four years (beginning in 2018–19, and $37.9 million per year thereafter) to make it easier for unemployed people to pursue self-funded training while receiving Employment Insurance benefits.

Data

- A new data initiative will be led by the new Infrastructure Bank to improve knowledge on the state of municipal and provincial infrastructure. The Infrastructure Bank will work with provinces, territories, municipalities, and Statistics Canada .

- CMHC is getting $241 million over 11 years for data collection and research and to test new design solutions to affordable housing challenges including in actual housing projects (part of the $11.2 billion housing package).

- Statistics Canada is being allocated $39.9M over five years (and $6.6 million per year thereafter) for a housing statistics framework – a nationwide database of all properties in Canada providing information on purchases and sales, the degree of foreign ownership, homeowner demographics, and financing characteristics.

- The budget proposes to provide $225 million over four years (starting in 2018–19, and $75 million per year thereafter) to establish a new organization to support skills development and measurement in Canada.

Access to benefits and financial services

- $12.5 million will be set aside from existing resources for a pilot project to help low-income families access the Canada Learning Bond. The CLB provides money to help low-income families save for their kids’ education in Registered Education Savings Plans. Only about a third of eligible families take this free money today.

- $12.1 million is budgeted in 2017-18 for improved service delivery for benefits for ESDC to improve access to services and benefits, beginning with Employment Insurance.

- A commitment to build Canadian government digital services is modeled after the US 18F/US Digital Service program and the UK Government Digital Service. These digital service teams have been heavily involved in initiatives to improve access to benefits.

Cities

- The federal government is looking to accelerate the launch of the Infrastructure Bank, having a board and CEO in place by the end of 2017.

- $300 million over 11 years will go to support the Smart Cities Challenge as part of the new Impact Canada Fund focused on “challenge”-based approaches to Canada’s big problems.

- Infrastructure funding for provinces for transit will be allocated based 70% on ridership and 30% on population.

- The budget eliminates the public transit tax credit as of June 30, 2017.

Grab bag

- A new affordable access to internet program with $13.2 million over 5 years to “help service providers offer low-cost home internet packages to interested low-income families.”

- A new chapter of the budget reflects the government’s commitment to introduce gender-based analysis. The chapter provides an overall statement on gender equity and gender context for a number of initiatives but stops short of actually publishing gender-based analysis of different measures.

- The government had committed in their platform to finding $3 billion in new revenue by eliminating wasteful tax expenditures. After an expert tax expenditure review, this budget finds $270 million worth of new revenue from eliminating a few credits, most of which comes from the public transit tax credit.

- $125 million for a “pan-Canadian Artificial Intelligence Strategy.” Also, Transport Canada will be working on regulations related to driverless cars and commercial drones.

- The budget increases by 2 per cent the excise tax on alcohol, indexing that tax to inflation going forward.

- The government is eliminating the Canada Savings Bonds (which apparently no one buys anymore).